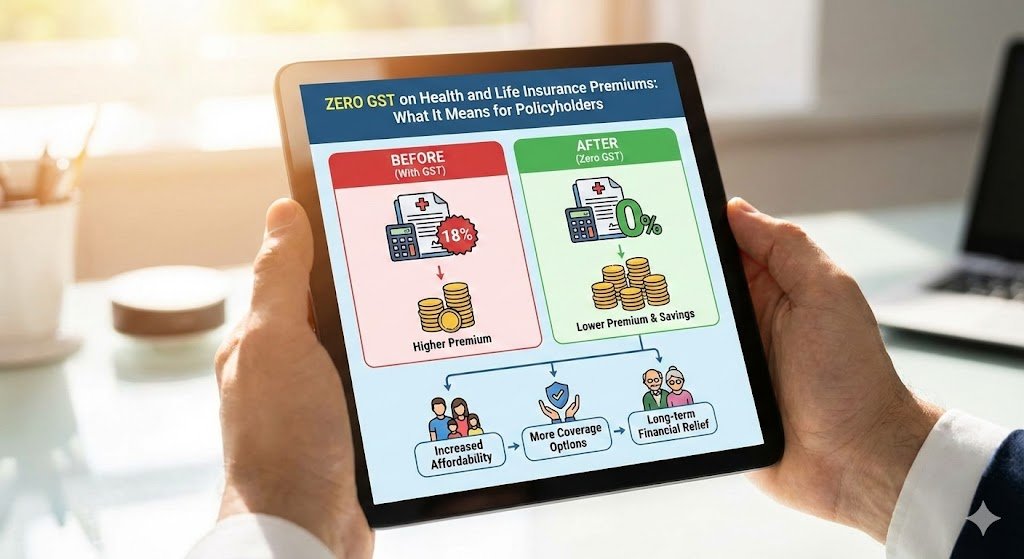

The Indian government has recently come up with a new policy where zero GST will be charged on health insurance and life insurance premiums and this has come as a lot of relief to millions of policyholders in the country. The premium prices have in the past been further strained by the Goods and Services Tax (GST) on health insurance and this has impacted on the affordability of insurance products. Due to this new development, the overall costs will be cut down and this will attract more people to take up these essential protection plans. This paper discusses the impacts of eliminating the GST on health insurance premiums to you, the wider implications of the issue, and ways in which you can manage these changes effectively.

The knowledge on GST on health insurance and life insurance premiums.

The Goods and Services Tax (GST) is a value added tax that is used in India on majority of goods and services including insurance products. Until recently, the GST on health and life insurance premium was 18 and this was significantly contributing to an increase in the yearly expenses to policyholders. This premium was part of the amount of tax paid by the insured.

The effect of the GST rate on insurance.

- The premiums under health insurance were subject to an 18% GST that added to the sum paid by policy holders.

- The same applied to life insurance policies which were subject to an 18% GST.

- This extra expenditure at times makes people refuse to buy or renew insurance cover.

Nevertheless, a decision by the government to introduce zero GST on health insurance of the health insurance and life insurance is meant to relieve the economic strain and encourage more people to have insurance cover.

The rationale and the change in policy.

The government declared that GST imposed on the premiums of health and life insurance will be offered a full tax break. The rationale behind this decision is that it promotes the greater vision of the government to ensure the accessibility of health services and financial protection to all citizens by lowering their out-of-pocket costs.

The important reasons behind zero GST of premiums in health insurance and life insurance.

- Dilution of fiscal impact:

- The tax exemption has a direct fiscal impact that decreases the insurance expenses of policyholders.

- Facilitating greater insurance enrollment: The rate of insurance cover of both health and life in India is still quite low; this action is meant to transform this by making insurance covers affordable.

- Preventive healthcare: Preventive healthcare will also be encouraged due to the availability of affordable premiums, which means more people will invest in health insurance and therefore achieve good health management.

- Financial services sector improvement: The BFSI industry can grow with more insurers requiring jobs and allowing them to innovate.

The direct impact of zero GST on policyholders.

To the already-insured policyholders, the abolishment of GST on health and life insurance premiums will imply that they will now be paying the base premium only and not the current tax percentage. This will be incorporated in new high-value invoices that the insurance companies will issue.

Individual and family advantages.

- Reduced insurance payments: Instant savings on insurance payments.

- Better affordability: Will allow additional families to retain or initiate insurance coverage.

- Simpler renewal experience: The low premium levels will make renewal cheaper.

- Higher peace of mind: Policyholders are able to remain covered as a result of less financial strain with less worry about the budget.

Market and Insurance company effects.

The insurance companies will be forced to change their pricing and billing systems to accommodate the zero GST frame. Although this could cut their GST collections this could be countered by higher volume of business through more policy sales.

Potential market effects

- Demand flattened on the health and life insurance products.

- More competition between insurers to provide value-added services.

- Improved innovation in insurance coverage and modes of payments.

- Increased consumer friendly products in the market to meet the different Indian demographics.

What policyholders ought to have in mind.

Although the zero GST rate will lower the amount of premium to pay. The policy holders must still review their insurance cover critically. The selection of the appropriate sum insured, reviewing of policy terms and interpreting of the exclusions are critical.

Suggestions on how to maximize on zero GST benefits.

- Amend the current policies to know about premium changes.

- Your insurance or financial advisor can provide you with new premium quotes.

- Have timely renewals to benefit the tax exemptions as soon as possible.

- Consider additional or top-up policies to have increased coverage.

- Comparison of insurance schemes amongst various providers increases.

Other indirect effects to monitor GST on health insurance.

While GST on health insurance premiums is now zero, other health related services and products may be charged GST. The policyholders are expected to note the difference between the insurance premiums and the medical services or health products.

Ensuring transparency in GST and health expenditures.

- GST exemption is not applicable to medical bills, but only in insurance premiums.

- Hospital fee, medicine, and diagnostics can be subject to GST according to the classification of services.

- The knowledge of such variations is useful in budgeting and tax reporting.

Conclusion

Indian consumers will be delighted to know that the zero GST was announced on health insurance and life insurance premiums. This will go a long way to reducing the financial burden on essential protection plans. This policy will not only reduce the cost burden on the current policyholders. It also increases the number of people who will choose to take insurance cover. Since GST on the health insurance is no longer in use policy holders ought. To review their insurance needs and make full use of the amount saved on the policy. With the insurance sector adjusting to such changes. An inclusive and an accessible insurance market in India will most likely arise; this is to the advantage of all the stakeholders involved.