India’s baby wear market isn’t just growing, it’s evolving. Parents today aren’t waiting to step into a store. They’re heading to Google first, looking up “organic baby clothes,” “kids wear near me,” and brand names that feel both safe and stylish.

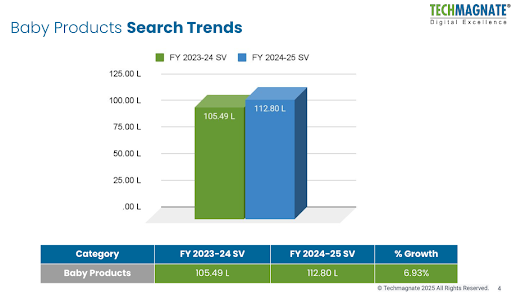

This growing reliance on search makes visibility a core competitive advantage in the baby wear market size race. According to the Baby Products Market Trends Report India 2025 by Techmagnate, a leading digital marketing agency in New Delhi, search volumes for baby products grew by 6.93% year-on-year, reflecting a surge in online discovery and digital-first buying behaviour.

A Shifting Market: Baby Clothes Brands Search Volumes

Despite overall growth, not every sub-category is moving in the same direction. Kids clothing, a popular umbrella segment, saw a 9.81% decline in search volumes in FY25. Meanwhile, more specific and niche queries like “organic rompers” and “cotton baby night suits” are rising.

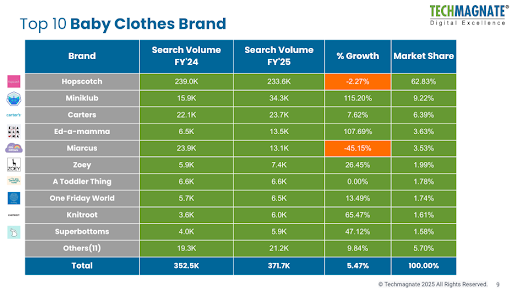

Search dominance continues to favour Hopscotch, which commands a 62.83% share of brand search volume. But this lead is being tested by the rise of purpose-led, sustainable fashion brands targeting younger parents.

The takeaway? The baby wear market share trend is shifting from broad, mass-market appeal to personalised, sustainable offerings.

For brands competing in high-growth segments like baby wear, visibility alone isn’t enough. The real differentiator lies in attracting the right audience through SEO strategies that deliver qualified leads, stronger engagement, and lasting brand equity. That’s where Techmagnate’s digital marketing services come in, designed to translate consumer intent into measurable business results

Fastest Growing Brands in Baby & Infant Wear

India’s baby and infant wear market is seeing a notable churn in brand visibility, with several new-age players rapidly closing the gap with more established names.

Among the brands showing the fastest YoY growth in search volume:

- Miniklub: +115%

- Ed-a-mamma: +107%

- Knitroot: +65%

These numbers point to a clear shift in consumer preference. Parents are moving toward brands that offer a blend of affordability, comfort, and ethical positioning. Miniklub and Ed-a-mamma, for instance, have built strong narratives around sustainable materials and child-safe designs, two factors increasingly influencing purchase decisions among millennial and Gen Z parents.

Knitroot, though relatively smaller in size, has tapped into the customised clothing segment, offering personalised prints and occasion-wear for babies and toddlers. This micro-niche strategy appears to be paying off, especially on platforms like Instagram, where the brand leverages high visual recall and peer-to-peer discovery.

Another key factor driving their growth is channel diversification. These brands are not limiting themselves to marketplaces. They’re investing in:

- Direct-to-consumer (D2C) websites with better UX

- App-led selling to reduce reliance on third-party platforms

- Content-rich storytelling that appeals to urban, mobile-first audiences

While large global and national brands continue to enjoy baseline visibility, it’s these emerging challenger brands that are gaining momentum by listening closely to what modern Indian parents actually want, that is comfort, convenience, customisation, and conscious choices.

The sharp growth in their search interest suggests they’re not just being discovered, they’re being considered.

“Search behaviour in the baby products category reflects a broader shift in how India shops. Parents aren’t just buying, they’re researching, comparing, and evaluating brands digitally before they decide. The brands that succeed will be those that blend trust with visibility.” says Sarvesh Bagla, CEO, Techmagnate.

What Parents Are Searching For: Keyword Trends 2025

The baby wear market size may be growing, but the way users search has evolved. The report reveals that:

- Non-branded searches like “baby clothes online” and “kids party dress” dominate discovery.

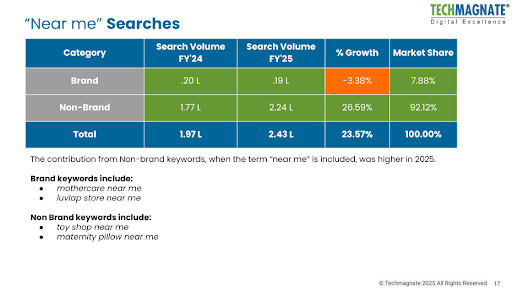

- “Near me” searches surged by 23.57%, indicating rising local purchase intent.

These trends highlight the growing need for local SEO, regional targeting, and mobile-optimised content especially for brands looking to engage high-intent shoppers in Tier 2 and Tier 3 cities.

According to industry experts at Techmagnate, non-brand keyword visibility will be a critical growth lever for baby clothing brands especially in a market where discovery begins with search, not brand preference.

Regional Growth: Tier 2 and Tier 3 Cities Take the Lead

One of the most significant findings in the Baby Products Search Trends Report is the shift in digital demand toward India’s non-metro regions. In FY25, Tier 2 and Tier 3 cities accounted for 61.36% of all baby product–related searches, growing at a robust 15.18% year-on-year.

This surge contrasts sharply with metro markets like Delhi, Bengaluru, and Mumbai, where search volumes have plateaued or declined slightly. These Tier 1 cities, while still dominant in absolute numbers, appear to be reaching saturation, with most digitally aware parents already loyal to a handful of known brands or shopping channels.

By comparison, Tier 2 and Tier 3 cities represent India’s fastest-growing buyer base driven by:

- Smartphone penetration and affordable data plans

- Increased comfort with online discovery and payments

- Digital-first young parents looking for product variety, deals, and reviews

- Limited offline availability of niche or premium baby brands

This shift signals a major opportunity for baby clothing brands to diversify their geographic focus. However, winning in these regions requires more than just ecommerce listings.

To capture meaningful visibility, brands should prioritise:

Hyperlocal SEO – Use neighbourhood, district, and city-specific keywords that match how people search in smaller towns (e.g., “baby wear store in Guntur” or “infant clothes Agra”).

Vernacular search optimization – Invest in regional-language content, especially for high-intent queries like “best baby dress near me” in Hindi, Tamil, or Bengali.

Localized product discovery – Leverage Google Business Profiles, location extensions, and retail store data to show availability in the user’s region even for D2C brands.

Regional influencers and micro-creators – In non-metros, trust is often built through community voices. Partnering with hyperlocal parenting influencers can amplify reach.

As this decentralised digital growth continues, brands that stay metro-focused risk missing the next wave of customers. The infant wear market growth story through 2030 will be written not in big metros but in cities like Indore, Coimbatore, Jodhpur, and Bhubaneswar.

Growth Drivers Shaping the Market

The baby wear market share trend is being shaped by three powerful forces:

Sustainable Baby Fashion

As awareness grows, parents are prioritising toxin-free fabrics and eco-conscious sourcing. Brands with an ethical story are seeing higher brand loyalty and search visibility.

Mobile-Led Shopping Journeys

The Hopscotch app saw 22% growth , reinforcing the shift toward mobile-led discovery. Brands must optimize not just websites, but app listings and in-app SEO as well.

Hyperlocal & Vernacular SEO

Local-language queries and regional search patterns are rising. Campaigns designed for specific geographies and languages will be key to growth in Tier 2/3 markets.

What This Means for Baby Brands in India

The baby and infant wear market size will continue to expand through 2030, but the path to growth is digital-first. The data makes it clear:

- Parents are searching more.

- They’re searching locally and in multiple languages.

- They expect relevance and value from the brands they discover.

To win this demand, brands must invest in:

- Ecommerce SEO for product pages and collections

- Local SEO to capture “near me” intent

- Vernacular content for Tier 2/3 visibility

- App and mobile SEO for platform-first users

The Future Belongs to Brands Who Lead with Search

The baby wear segment is no longer niche, it’s mainstream, digital, and competitive. With users turning to search for everything from size charts to brand comparisons, the opportunity for visibility is immense.

Brands that act now by embracing SEO, understanding search behaviour, and targeting emerging regions will be poised to lead in India’s next phase of baby retail.

Techmagnate’s Baby Products Market Trends Report in India is more than just data, it’s a roadmap for digital growth. Download the full report today.